Austin has made it through year three of his business. He’s a bit more established and feels confident that he can keep cash flowing to keep the doors open, but he’s becoming more focused on profit. He needs to be if he wants to survive and grow. Austin’s gross profit is his sales price per bicycle or part sold, less his direct costs of buying the bicycle or part from his supplier and any related costs. Austin’s net profit will be what’s left over from the gross profit of all his sales after he deducts his remaining operating costs: the salaries of the people working in the shop, rent for his shop space, advertising online and in local publications, utilities, interest on debt, and taxes.

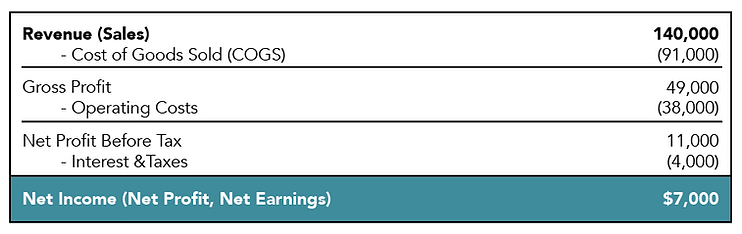

For his third year of operations, this is what his profit looked like:

Austin’s gross margin is 35 percent ($49,000/$140,000). His net margin is 5 percent ($7,000/ $140,000). For retailers, those margins are average, but you’d expect higher than average margins for a specialty retailer like Austin.

Austin was disappointed with his operations. His monthly sales revenue was increasing. However, his expenses had also been creeping upward. His cost of goods sold had suddenly jumped because of supplier consolidations and price increases. His overhead had also grown faster than sales because he had hired two part-time employees – a service and repair technician and a sales clerk.

Since Austin’s margins were declining, he had a big problem: He wasn’t earning much personally. If something didn’t change, his family wasn’t going to be able to afford his business much longer.

Austin was earning $300 for every higher-end bicycle he sold:

He had two options to increase profit: (1) raise revenues by increasing prices or selling more of his products and repair services, and/or (2) lower his costs. If he raised his prices, his gross profit would be greater on each bicycle sold, but he might sell fewer units and reduce his total gross profit. If he lowered his sales prices, he could sell more bikes, but at a lower gross profit. Would the increase in sales make up for that? If he could reduce his cost of goods sold (the cost of the bicycle), he could lower his price, maintain his gross profit on each unit, and increase sales – creating greater cash flow and profits. But the cost was set by his supplier.

The way Austin saw it, his two options were actually four:

-

Try to negotiate with his supplier to lower his cost of goods sold to $600 to enable a lower sales price of $900 while keeping a gross profit of $300. The lower prices could increase sales, thus increasing total gross and net profits and cash flow.

-

Try to lower cost of goods sold to $600, keep the same sales price of $1,000, and increase gross profit to $400.

-

Increase the sales price to $1,100 if cost of goods sold stayed at $700, to generate higher gross profit of $400.

-

Increase sales price to $1,100 and lower cost of goods sold to $600, to create gross profit of $500.

Austin decided customers would pay more for his products, so the first tactic he tried was to raise the price of his best-selling bike by $100. His gross profit per bike increased to $400. But instead of increasing his total gross profit, the strategy reduced his gross profit by $200! What happened? He had averaged ten sales per month for a total gross profit of $3,000 – to be increased, he had hoped, to $4,000 (10x $400). However, the next month he sold only seven bikes at the higher price for a total gross profit of only $2,800 (7x $400). His strategy had backfired, so he dropped his price back to the original.

To lower his cost of goods sold, Austin began shopping for a new supplier who might compete for his business. It worked. He found a second supplier and used its pricing to negotiate a better deal with his current supplier. He was able to reduce his COGS by $100, putting his gross profit at $400. Sales held at about ten bikes per month, increasing his total gross profit to $4,000 per month. Things were looking up.

A few months went by with increasing sales, and Austin decided to take a risk and decrease his sales price to $950 to see if he could increase the number of bikes sold. Sales jumped up to twenty units each month and he was raking in $7,000 a month in gross profit. Things were going so well with the current price and gross profit that he decided to stick to the formula.

Austin was happy that his profits were on the rise, but he also realized that he could be doing a better job controlling his operating expenses – his overhead. For the year, his overhead would be higher than the previous year because he had two employees for the entire period. He was watching his bottom line carefully. New bike sales revenue was outstripping bike-servicing revenue, so he decided to reduce the hours of his service and repair technician. He also reduced the hourly pay of his sales clerk and created a sales commission incentive plan. His sales remained on an upward trend, and he felt sure his net profit margin would look better this year.